How the Muslim Debt Collective Works to Help Debt-Strapped Muslims

Lifestyle

|

Aug 26, 2020

|

7 MIN READ

Saadia Yaqoob and Zaid Adhami, the co-founders of the Muslim Debt Collective

Saadia Yacoob came to the U.S. to Virginia from Pakistan with her mother when she was 16 years old. She faced financial roadblocks while trying to pursue educational opportunities without taking out loans as she learned to navigate the American debt system. Trying to avoid riba, or interest, was important to her as it is prescribed by the Quran. Similarly, she and husband Zaid Adhami noticed friends and family facing financial hardships (in addition to their own) and struggling to overcome debt and high interest loans.

“For the past four years there were a number of friends and individuals [with whom] we could discuss with their situation, where they were in real predicaments connected to issues of either domestic violence, some kind of abuse or just ugly divorce situations and custody issues,” says Zaid.

They could see this was a real problem for too many Muslims, and they decided something needed to be done. The couple reached out to family and personal networks and raised about $20,000 to pay off some loans for struggling Muslims and also offered mini loans without interest.

After collecting money from family and friends in their network the past two years to help others pay off interest-bearing loans, they realized it was a much bigger problem needing a better solution. Saadia and Zaid took to Facebook, posting a status to inquire whether there was an interest to continue this work on a larger scale. Twenty friends answered the call, coming together to pool their expertise and resources.

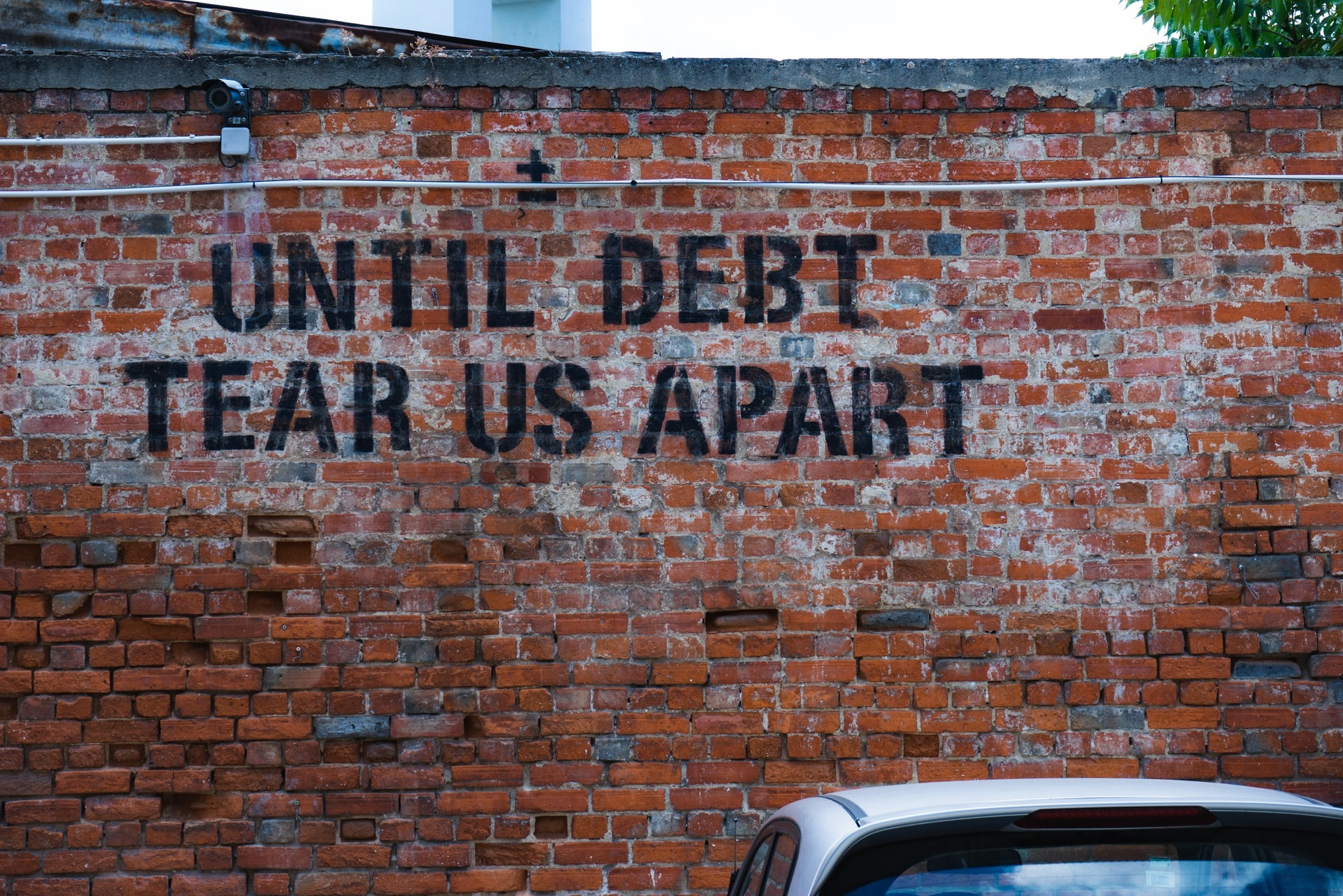

Together, on July 22, they launched and co-founded the Muslim Debt Collective. The collective aims to raise awareness about the debt crisis in the United States, relieve Muslims of debt – which keeps them trapped in difficult life circumstances and cyclical poverty – while mobilizing the American Muslim community to develop long-term alternative solutions to debt.

“Debt ... in the American system is normalized. (People have) tremendous privilege when they don’t have to live in significant debt,” says Saadia. “There are national conversations about debt, student debt, medical debt … which led us toward a project that focused on these things.”

How Debt Grows By Way of Two Approaches

The collective launched early due to the COVID-19 pandemic. “Rather than taking a longer time to really sort through and think through details, [we decided to] just go ahead and launch something and start working with individuals to raise funds,” Saadia says.

Saadia and Zaid are assistant professors at the Williams College in Massachusetts, teaching in the department of religion. They met while attending Duke University to pursue their PhDs and married one-and-a-half years later. Saadia and Zaid were active in their respective communities through community organizing in Muslim spaces, and their professional pursuits and service work led them to think about ways to make Islam relative to a broader community by drawing from Islamic tradition, personal experiences and research.

In their research, Saadia and Zaid learned that American Muslims approach debt and interest in two forms: the accommodations approach, which constitutes incurring what the individual deems is necessary debt to buy, for example, a house or car or when dealing with a financial crisis; or a formalistic approach, which is the decision not to engage in interest-based loans, which then makes it difficult at times to pursue education or when some sort of life hardship occurs.

“We’re hoping the Debt Collective can move us as a community beyond [these two] approaches,” Saadia says, asking, “Why has debt become so normalized?”

“The Quranic idea is that the wealth that you are given by Allah (S) is not yours. You don’t just get to keep. It’s a blessing and gift from Allah (S), and other people have a right over it,” says Saadia. She hopes the Collective can help brainstorm alternative options to interest-bearing loans and remove the blame on Muslims who are trying to make ends meet or get ahead in life.

Historically, Muslims lived without financial hardship to cover basic necessities due to communal social services, she says. For example, “Lost income [didn’t]necessarily mean that you didn’t have food to eat,” however in the American system, “If you don’t earn the income or enough of it to have food and home and medical treatment, [it unfairly implies that] you didn’t work hard enough.”

She asks, “How do we reclaim our (Islamic) history?”

How the Muslim Debt Collective Helps

Muslim Debt Collective focuses on families who “simply don’t have a choice to not be in debt,” says Saadia, referring to those who depend on a sole breadwinner, a provider who possibly works three jobs to make ends meet; individuals in dire situations like divorce; or a provider falling ill, which brings upon financial hardship.

Saadia says families need help to get past basic survival through long-term debt relief that goes beyond immediate urgent situations.

“Talking about the possibility of living without debt is very difficult until you can relieve their debt and (think about) the other aspects of their lives that prevents them from making those kinds of choices,” she says.

Zaid says the organization is looking for ways to “get more people on their feet and get a fresh start instead of, for example, someone needing rent money for two months lest they become homeless.”

He adds, “Debt is a trap. If we can relieve people of their trap, it’s a long term fix for one family at a time as opposed to a bandaid for their immediate needs.”

Zaid says they hope to raise funds for families while pushing community initiatives to step up and provide alternatives. One of those aspects involves researching and developing a credit rotation system and providing small or micro loans without interest. Zaid says these ideas are not new, however they are not fully explored in America, unlike in Syria where Zaid was born.

“People from our generation have forgotten these things exist,” he says. “Loan companies deliberately target people with no means.” And, while as a community we have “sharia compliant mortgages,” for those who have the means, Zaid says “there are no conversations about how to give non-riba fair loans to people who really need it ... some of these people who can't afford $40 to fix a tire.”

In America, we tend to “place all the burden on the individual ... you should not take out interest based loans,” without realizing that you are being targeted by an exploitative financial system, says Zaid “The Quran and sunnah say interest is haram due to its vulnerability and exploitation.”

Inspiration for the Muslim Debt Collective

Saadia and Zaid were inspired by A Continuous Charity and Believers Bail Out, two groups that focus on the “tyranny of debt, particularly its manifestations in mass incarceration and higher education,” according to their Facebook page.

For its first phase, Muslim Debt Collective is working with families through FAITH Social Services in Virginia, which provides families with shelter, resources and financial literacy, to get them back on their feet. While the organization pays for counseling, provides legal aid and long term shelter, the Collective supplements them with debt relief.

“We really like the fact that helps families that already are moving toward financial stability,” says Saadia.

“FAITH has the expertise and experience to work with those clients on how to pay off [debt] and negotiate their loans, a win-win situation,” says Zaid. “We’re helping them address their needs among their clients, giving them our first stage of the project, which makes our work much more effective ... [before we] expand to other social services.”

Saadia says they hope to expand their work to urban Muslim communities, particularly Black Muslims, who are often left out of the financial capital in suburban communities, which is rotated and stays in those areas.

Thus far, Saadia says they have had a tremendous amount of interest, appreciation and curiosity in the early weeks of the Collective.

“Debt people is a problem, and relieving people from debt is a very important aspect of being a pious Muslim in Islam,” she says. While they haven’t issued any monetary debt relief since launching last month, they are raising money for one Muslim sister, Fatima.

The Collective is working to raise $19,800 for Fatima, a domestic violence survivor, who is struggling to pay off car payments while working and taking care of her autistic son. This story was shared on the collective’s Facebook page:

"Without transportation, Fatima was unable to procure a job. Finally, with a loan from a friend, she was able to purchase a used vehicle, allowing her to begin working at various fast food chains. Unfortunately, the car was often in need of repairs and eventually broke down. To keep her employment, Fatima purchased another vehicle but at a high-interest rate, due to the predatory practice of subprime car loans – lending to people with poor credit at exorbitant interest rates.

"As a survivor of childhood and adult trauma, Fatima has had difficulty sustaining work. In 2018, her ex-husband returned their son to her custody but did not provide any financial support for the care of the child. As Fatima’s son is a special-needs child, managing his care requires a great deal of attention, requiring Fatima to take a lot of time off from work. This led not only to a significant loss of income, but also caused her to fall deeper into debt."

There are so many Muslims like Fatima out there who need help getting out of debt, Zaid says, emphasizing the importance of helping fellow brothers and sisters struggling like this in our communities.

The initiative works on a case by case basis to raise the appropriate funds for those in need. For more information, click here.

Subscribe to be the first to know about new product releases, styling ideas and more.

What products are you interested in?